Traders should also look for negative divergence between a popular indicator, such as the relative strength index (RSI), and price.

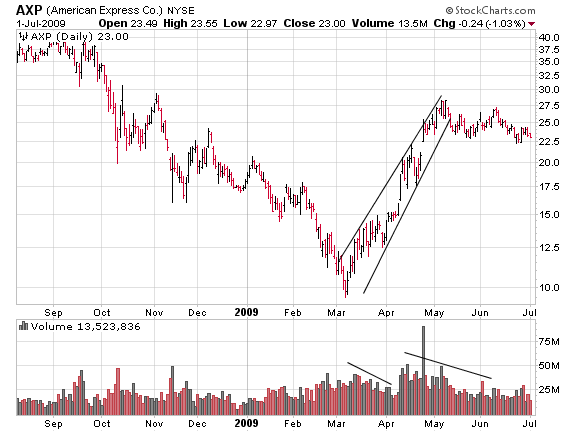

Price failing to reach the upper trend line frequently is one such warning sign. The pattern is also known as ascending wedge due to the way it appears on a chart. Sellers enter the market before the line converges, and as a result, prices lose momentum which causes prices to break out of the upper or lower trend lines, but the prices usually break out in the opposite direction of the trend line. Breakdowns: Before traders take a short position when price breaks below the lower channel line of an ascending channel, they should look for other signs that show weakness in the pattern. The rising wedge is a technical trading indicator that signals trend reversals or continuations, usually within bear markets. When stock prices have been rising for a while, two converging trend lines form a rising wedge.For example, traders could require that a significant increase in volume accompanies the breakout and that there is no overhead resistance on higher time frame charts. It is prudent to use other technical indicators to confirm the breakout. The rising wedge consists of two converging trend lines that connect the most recent higher lows and higher highs. Breakouts: Traders could buy a stock when its price breaks above the upper channel line of an ascending channel.For example, if a trader places a $5 stop, the width of the ascending channel should be a minimum of $10 to allow for a 1:2 risk/reward ratio. Traders who use this strategy should ensure there is enough distance between the pattern’s parallel lines to set an adequate risk/reward ratio. The pattern is identified by drawing two.

A stop-loss order should be placed slightly below the lower trend line to prevent losses if the security’s price abruptly reverses. Symmetrical Triangle: A chart pattern used in technical analysis that is easily recognized by the distinct shape created by two converging trendlines. Support and Resistance: Traders could open a long position when a stock's price reaches the ascending channel’s lower trend line and exit the trade when the price nears the upper channel line.No representation is being made that any account will or is likely to achieve profit or losses similar to those strategies shown on this web-site.Image by Sabrina Jiang © Investopedia 2021 Trading the Ascending Channel Also, since the trades have not been executed, the results may have under or over compensated for the impact, if any, of certain market factors, such as lack of liquidity. Unlike an actual performance record, simulated results do not represent actual trading. Hypothetical or simulated performance results have certain limitations. Past performance of trading strategies are not necessarily indicative of future results. A wedge is a market consolidation zone, bound between two sloping support and resistance lines, which would eventually converge.

No representation is being made that any account will or is likely to achieve profits or losses similar to those discussed on this website. This website is neither a solicitation nor an offer to Buy/Sell futures. Don't trade with money you can't afford to lose. You must be aware of the risks and be willing to accept them in order to invest in the futures markets. DISCLOSURE: Futures trading has large potential rewards, but also large potential risk.

0 kommentar(er)

0 kommentar(er)